NETWORK

access to more than 6,500 in-house tax professionals across the globe

At every stage of your tax career, Tax Executives Institute will help you succeed and advance the tax profession.

Whether you lead the tax function of your company or are just starting your tax career, TEI has opportunities to enhance your network and benefit your career:

Heads of Tax/Chief Tax Officers (CTOs) are afforded access to an exclusive CTO group with monthly discussion calls, a private CTO-only discussion group in TEI Engage, TEI's member-only online community, and closed discussions at our Annual and Midyear Conferences. The ability to develop relationships with other heads of tax in these CTO-only forums ensures that CTOs develop relationships with their CTO peers, allowing for invaluable knowledge sharing.

TEI provides unique professional growth opportunities for tax professionals in management and leadership roles within their companies. In addition to offering state-of-the- art conferences and seminars, all TEI members can join our 16 standing committees, work with subject matter experts to develop and moderate conference sessions, and participate in chapter leadership, thus further developing their tax technical expertise and leadership skills while giving back to the tax community and delivering real value to their companies.

TEI provides numerous opportunities for those beginning their tax career. Those at the beginning and intermediate stages of their careers can advance their technical expertise by attending TEI’s courses, seminars, and conferences, attending local chapter meetings, and joining standing committees dedicated to tax technical matters. In addition, young tax professionals can easily connect with fellow colleagues through TEI’s Young Tax Network, Women’s Tax Network, and Student Committee. Forming long-lasting relationships with peers and more seasoned tax professionals outside their companies offers young tax professionals invaluable guidance and mentorship at this pivotal stage of their careers.

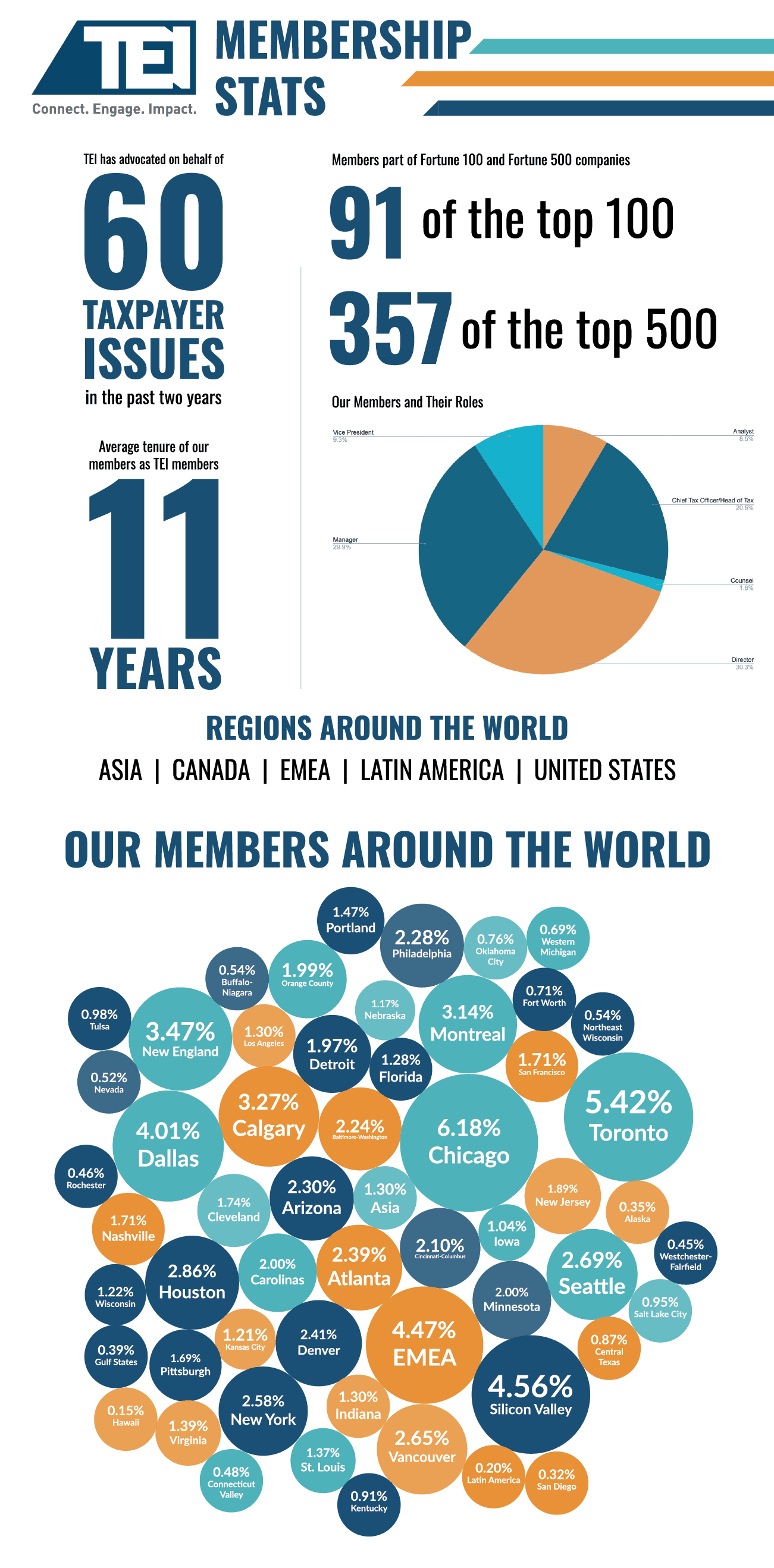

TEI is a global membership association formed exclusively for in-house tax professionals. Our more than 6,500 members come together to share information, stay abreast of the latest technical, technology, and tax management trends, and advocate for sound tax administration to help their companies.

Representing more than 2,800 leading companies, TEI is the must-join organization for all in-house tax professionals, providing an inclusive, close-knit community that furthers your personal and professional growth and success.

As a TEI member, you have unparalleled opportunities to share information with other in-house tax professionals through access to our robust network of in-house tax executives facing the same challenges and opportunities. TEI also provides direct connections to prominent speakers and subject matter experts from our more than 75 accounting, law, consulting, and technology sponsor firms. Members can also meet and develop relationships with tax administrators and governmental officials from our advocacy efforts, ensuring that their company’s voice is heard.

The adage that “the more you give, the more you get back” applies at TEI. Members are encouraged to actively engage with TEI by getting involved in local chapter activities, participating in one of our 16 standing committees, attending chapter, regional, and Institute events, and asking questions and sharing expertise in TEI’s member-only, online community, TEI Engage. Our Membership Team is available to help each member customize their TEI involvement to ensure an enriching and meaningful experience.

TEI is a well-respected industry leader and maintains long-standing relationships with government agencies throughout the world, including the U.S. Internal Revenue Service and U.S. Department of Treasury, U.S. state and local tax administrators, the Canada Revenue Agency (CRA) and Canada Department of Finance (DOF), the European Commission (EC), the Organisation for Economic Co-operation and Development (OECD), and more. Members can share their views and directly influence tax policy by participating in TEI’s standing committees and advocacy efforts, ensuring that governments hear perspectives and respond to the corporate tax community.

access to more than 6,500 in-house tax professionals across the globe

chapter, regional and institute level events

exclusive access to member-only events

16 tax technical committees

influence critical tax issues

direct access to government officials

TEI's bi-weekly bulletin featuring content from leading tax firms

TEI's member-only

online community

TEI's bi-monthly

professional journal

Full membership is available for all in-house tax professionals who are employed by corporations or other businesses and are charged with responsibility for directly or indirectly administering the taxation of their organization, including accounting, finance, tax technology, unclaimed property, and other tax-related matters.

The annual dues for full members is $275.

Student membership is limited to individuals enrolled full-time in an undergraduate or graduate program that provides an appropriate foundation for a career in taxation. Student members may not be employed full-time in any tax-related position, though certain limited unpaid internships with firms engaged in public tax practices may be eligible.

The annual dues for student members

are waived.

Emeritus membership offers an excellent way to stay connected with the TEI tax community during retirement and is available to members or former members who have retired from qualifying employment and who are not otherwise gainfully employed.

The annual dues for emeritus members is $25.